The state guarantees each person the right to check his credit report for free on the website AnnualCreditReport.com once a year. But once a year it is too rare for constant monitoring, so you can check it at least every day, there are a lot of applications for this. But…

They all have different Credit Score calculation formulas, and the data can vary, so it makes sense (if you are aiming for a very large purchase, for example) to check reports using several credit score apps.

WalletHub

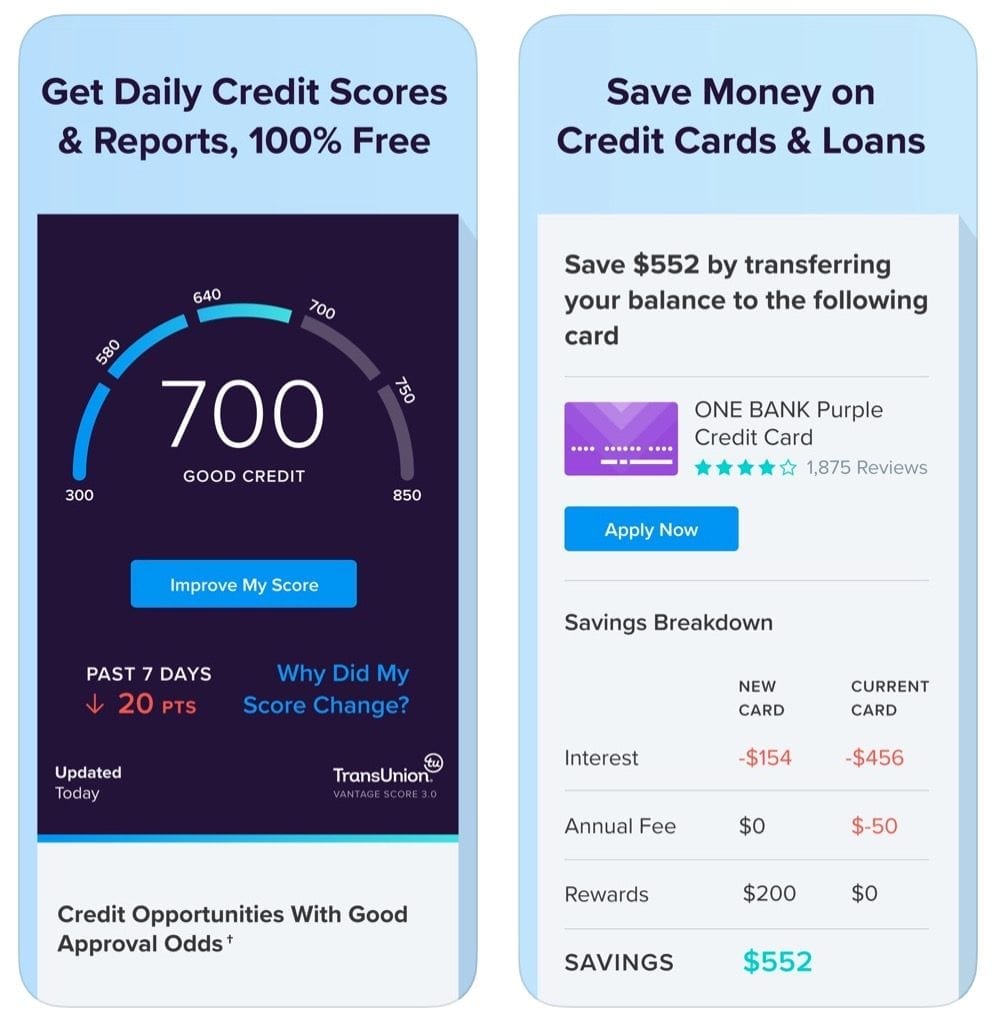

You just need to sign up for a free account in WalletHub and you’ll get your free credit score and personalized tips as well. You will learn how to save money and improve your credit score if needed.

Other useful features of the WalletHub application:

- An action plan for improving your score;

- 24/7 credit monitoring. So you will be notified if there is an important change;

* In addition to email alerts, you can also customize your WalletHub account to receive SMS notifications. Most credit monitoring services don’t provide this.

- A system of smart notifications allowing to repay your debt faster and avoid overpaying on your credit cards and loans;

- You’ll get a custom-built debt payoff plan.

You may also like: 8 Best Vault apps for Android & iOS

myFICO

Other useful features of the WalletHub application:

- View your credit history and how it affects your credit scores;

- Get detailed information about credit changes;

- Watch videos and other educational tips to learn about credit and FICO Scores;

- Explore how different actions could affect your FICO Scores.

This is one of the best services to check your credit score and get full credit reports based on data from the three largest credit bureaus – Experian, TransUnion, and Equifax.

TransUnion

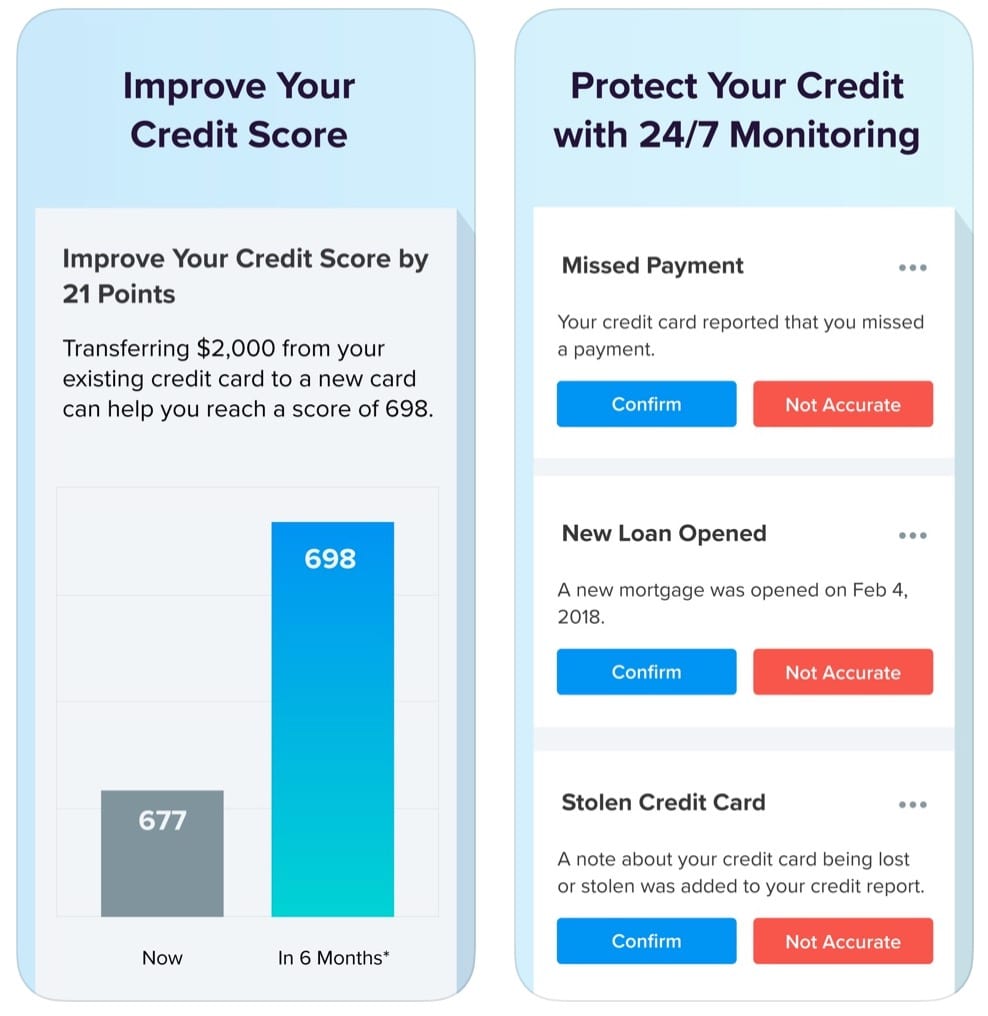

Useful features of the application:

- Refresh your daily score every day;

- Get recommendations based on your personal credit score goals;

- Receive notifications from 3 bureaus about important credit-report changes;

- Calculate your debt-to-income ratio with Debt Analysis service.

Credit Sesame

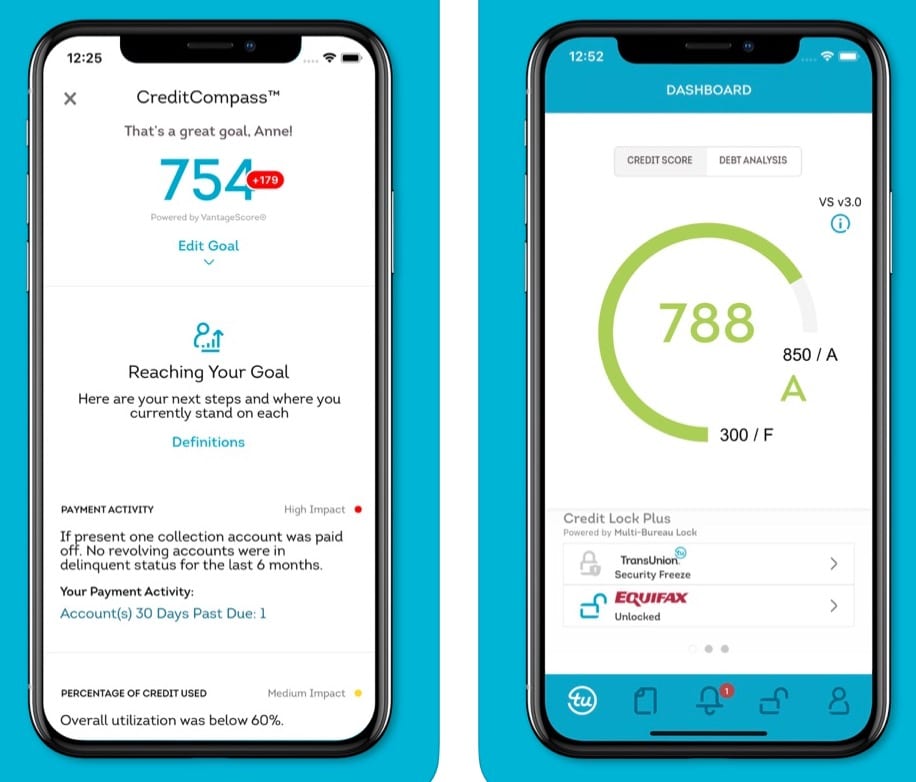

Other useful features of the application:

- Get your free credit report card;

- Control your credit score using a custom action plan;

- You will be notified of identity theft and fraud with free 24/7 monitoring;

- Personalized recommendations for the best credit cards, mortgage rates, and refinance options.

Experian

Experian can help you increase your FICO score by using bills that you already pay to apply for a loan. Your new credit points will take effect immediately.

The company monitors identity theft and scans the dark web pages daily to determine if your information has been stolen. If something is discovered, Experian support team will help.

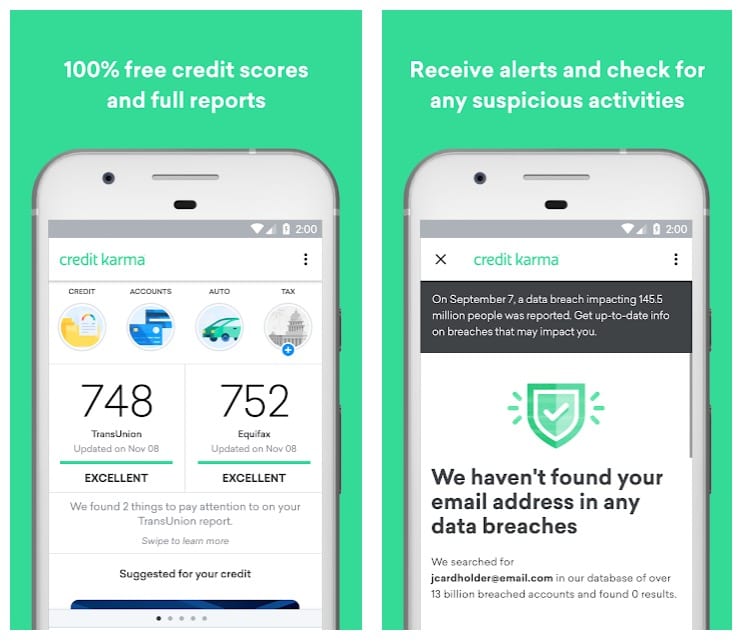

Credit Karma

A very popular service for free tracking of your credit history and any changes in it. Credit Karma helps users evaluate their credit rating and improve their financial situation.

A very popular service for free tracking of your credit history and any changes in it. Credit Karma helps users evaluate their credit rating and improve their financial situation.

Here you can find out your rating on the scale used by TransUnion and Equifax credit bureaus, read about the factors that influenced your rating, and also receive recommendations on how to improve it. The big plus is that the service is free – it makes it possible to check your credit score at least every day.

In addition to the basic credit monitoring service, the app offers complete information about credit cards of various banks and even allows you to compare their interest rates and bonus offers.

Now the company is launching a new feature – a service that returns various unclaimed payments, TechCrunch writes.

In the United States, the total amount of unclaimed payments is more than $ 40 billion. This amount consists of such things as cashless paychecks, old bank accounts, tax, and insurance payments. After a company or financial institution loses contact with the person whom they need to pay something, this money is transferred to the state authorities until they are requested.

Thanks to the new feature, users can search for funds held by the authorities of the states where they live or once lived. In addition, the application will notify them in advance of unclaimed funds in the future.

Personal finance control applications help their users improve their financial situation in various ways: for example, Clarity Money helps to save an average of $ 300 only by canceling old subscriptions to online services, and the Digit chatbot discreetly removes insignificant amounts from the owner’s accounts and saves them to bank deposits.

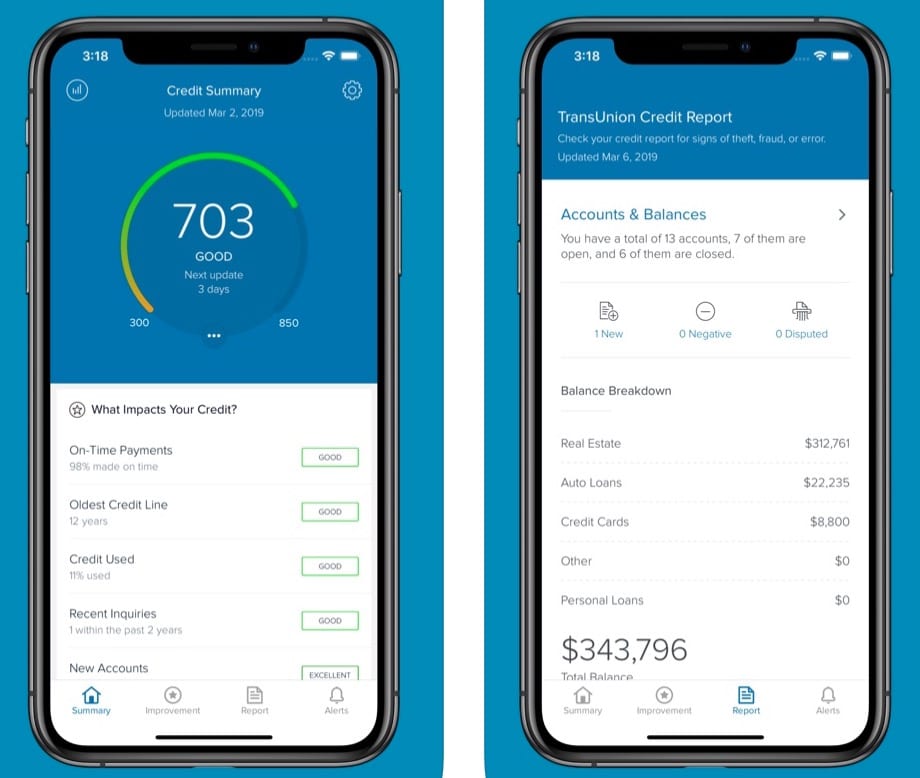

CreditWise

In the Capital One application, you can upload a photo and create a customer profile in order to personalize it. For Capital One, this is a real goal: to make the bank a part of the client’s life, and not vice versa.

The main features of the application:

- Check your credit score;

- Review your credit report in order to identify and fix errors;

- Improve your credit score using personalized recommendations.

Credit Wise – a free credit score with detailed info that helps customers understand what the score is and how to improve it.

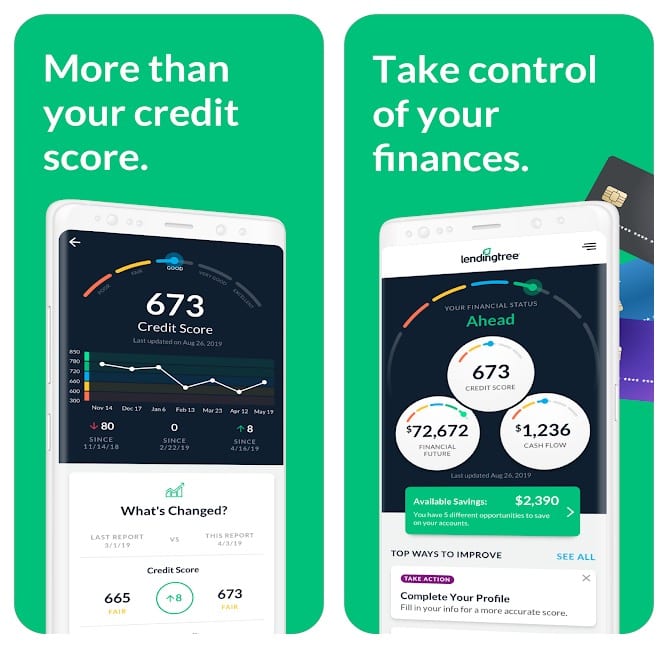

LendingTree

The main features of the application:

- Helps to plan your long-term financial future;

- Finds the ways to save;

- Monitors and offers ways to boost your credit score.

You may also like: How to remove spy apps from your gadget

ScoreSense Scores To Go®

The main features of the application:

- You can track your score and learn how your credit scores perform over time;

- See important factors affecting your credit score;

- Get alerts about changes that may pose a threat.

A credit rating is an indicator of your financial health, therefore prevention, like in medicine, is very important: you need to constantly check your credit history for any problems and prevent “diseases”!