Rounding up spending is a comfortable way to save a decent amount of money discreetly. This way, all you have to do is set a comfortable rounding-up rate that will come into your savings account.

This is why we have compiled the best savings apps today. In addition, we suggest taking better control of your savings together with the article Best My Track Cost Calculator Apps.

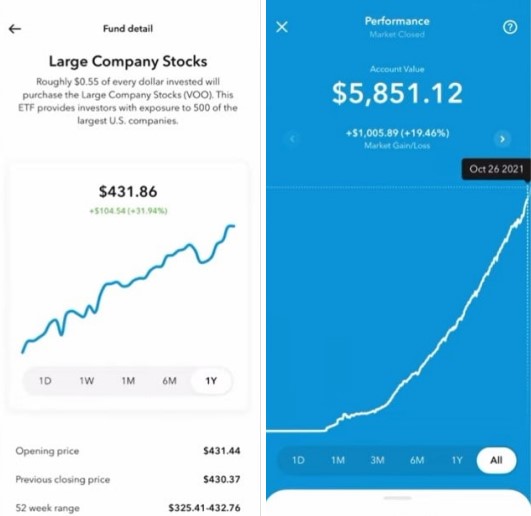

1. Acorns

This app will help you invest in your future. When you sign up for the app, you will be asked to take a mini-quiz, through which the app will determine your investment goals. The main function of this application is rounding up the total amount of purchases in any store.

You will be able to set a price interval, and the money will be automatically sent to your savings account. In addition, the app allows you to make automatic payments that will increase the growth of your portfolio. Also, every month you can see how much your portfolio has grown and evaluate your investments.

In addition, the application will help you invest and give you various tips. The app will also estimate all risks and provide you with information when you invest.

You may also like: 9 Best Gas Saving Apps

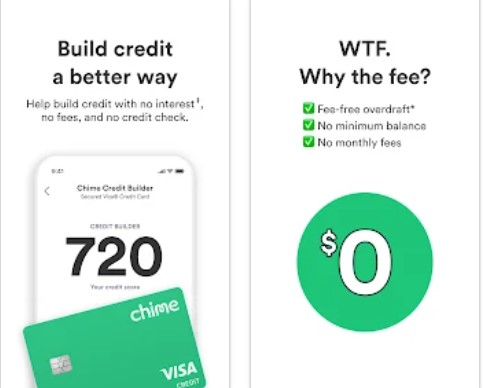

2. Chime

This app will help you get detailed information about your spending and start investing with ease. When you enter the application, you are greeted by a sign-up sheet. It is also worth noting that the main page of the application contains all the necessary functionality and you do not need to spend a lot of time figuring out how to use the app.

It is similar in functionality to standard banking software. You can recharge your account and make payments in any store. Also, if you make purchases, the application instantly notifies you about the purchase and informs you about your account balance.

The app also allows you to invest in a third-party company or create your own savings account. In addition, the app allows you to round up your purchases and send the rest to your savings account, for further investment.

You will also be able to set up an auto-payment that you want to invest in your savings portfolio. It is worth noting that the app has no monthly maintenance fees, allowing you to save your money faster. In addition, the app will help you get paid much earlier with a direct deposit payment.

3. Qapital

This is another application that will help you save money. The functionality of this application is quite simple. It will allow you to make auto-payments, through which the service will send your money to your savings account. The app also allows you to issue a debit card that you can use to access these funds.

In addition, the app uses a rounding feature to round up your purchases so that whenever you make a payment in a store, the app will round up the number of your purchases and deposit the balance into your savings account. The app also provides you with capital investments that will allow you to make trades.

In addition, the app has ready-made portfolios that you can instantly invest in. Moreover, the application has many features which will relieve you from any temptation and save you money.

In addition, the application can help you automatically save money to pay taxes. With each payment that comes into your bank account, you will be deducted for taxes, which will allow you to pay your future taxes.

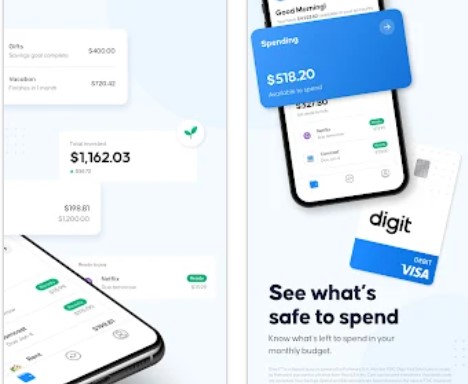

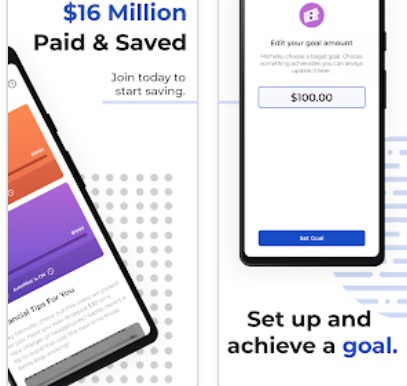

4. Digit – Save, Budget, & Invest

This app will help you achieve your short and long-term financial goals. When you sign on to the app, you are required to take a brief test, through which the service gets an understanding of your savings goals and your future investments.

The app uses many features that allow you to get daily analyses of your bank account, gaining access to your spending and habits on which you spend more money. Also, the app allows you to get paid much earlier, thanks to a direct deposit that you can set up. In addition, there are many funds in the app that you can invest in.

Besides that, the app offers you the ability to save for retirement with an IRA. In addition, the app allows you to create a debit card to help you invest within your established budget.

5. Qoins: Pay Off Debt/Save Money

This app is designed to help you pay off your debts and save money much faster and more conveniently. When you sign in to the app, you will need to select a financial goal, through which the app will understand your targets and handle all the rest. The functionality of this app is similar to any third-party service.

So, you can set up rounded purchases, which will make the app charge you and send your money to your savings account. There are also many investment portfolios in the app that you can invest in. In addition, the app allows you to link debit and credit cards and check accounts within the app.

In addition, you can also get a checking account through which the app will provide you with information about your spending and analyze your purchases. The account activity tab will allow you to view each rounding transaction, which is sorted by day.

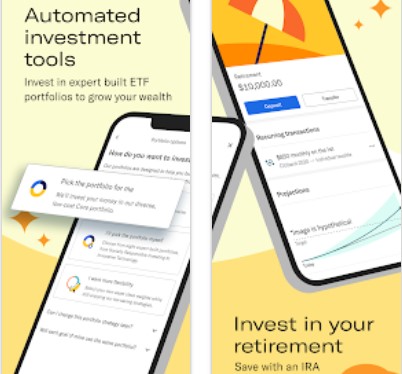

6. Betterment: Investing & Saving

If you want to manage your life savings, current accounts, or investments in one place, this is the service right for you. This is a savings app that helps you keep your budget in balance and earn dividends. In addition, you can also receive interest on the funds saved in your account.

And, of course, it can set goals that you have always dreamed of achieving. In addition, this program will be useful if you take care of your funds and want to save them. There is a special protection and insurance program.

In addition, this service is a broker with a personal advanced assistant who will help you make investments from any location more structured. It is also a great program to keep track of all the expenses and increases in your savings in one place.

You may also like: 11 Best Price Tracker Apps for Price Drop Alerts

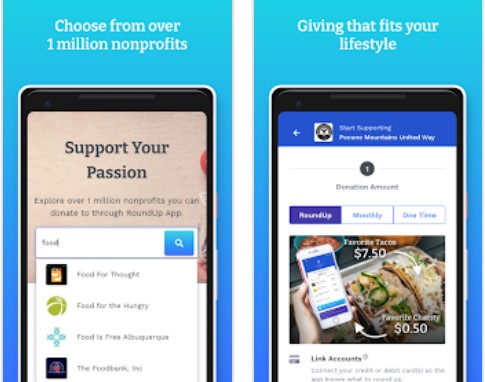

7. RoundUp App

This is a cool app that offers you to round up your purchases. So for each purchase, the app collects a certain sum, which you set yourself. Moreover, here you get a total amount at the end of the month, which you can spend on your needs. In addition, the app invites you to donate to several organizations in need.

You can also choose an organization by searching for it in the app. In addition, you can donate any amount you feel necessary. Also, the app offers you to link your credit or debit card in just a few steps to make it easier to use the app.

In addition, there is a convenient way to keep track of a rounding up of your purchases. So you can view how much you have saved from each of your purchases.

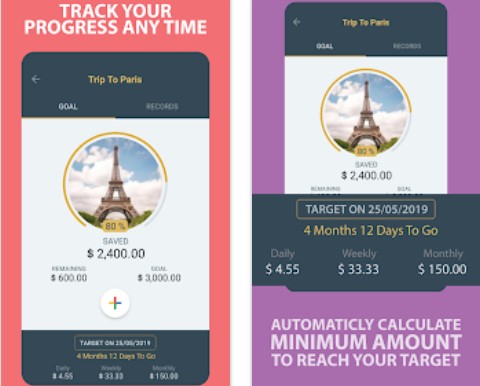

8. Savings Goal

This program is a real boon if you have dreams. Here you set your own goals and move steadily toward them. For example, you are saving up for a car and need a certain amount of money. So the app prompts you to save a certain amount of money for you to reach your goal soon.

In addition, you can set your own goal to which dollars will be added daily. The app can also pause saving if you feel that saving has become uncomfortable. In addition, you can view how much you have saved per day, week, or month. Besides, there is a nice interface that graphically shows you how you are moving toward your goal.

You can also put a specific photo of your goal and a description. This makes approaching your goal even more enjoyable. In addition, you will also see how much you have already been able to overcome as a percentage.

9. Up — Easy Money

This is another program that controls your budget. It also offers you a smarter approach to saving. The app has several useful features that allow you to move much faster toward your goals. It also tells you more about your economic status.

For example, it has not just the amount of money you have saved, but also the quantity of money that you spend per month. Moreover, there is a handy percentage ratio which also allows you to control your budget more accurately. The app also notes any changes that occur to your wallet.

In addition, you can quickly identify your new goals by easily adding them to your screen. In addition, there is a feature that allows you to communicate with your friends and send them money directly in the app.

All you have to do is to invite your friends and family members so that they can receive funds as well. The app also works with large organizations. That way you can easily round up your subscription fees so you can save money even faster.

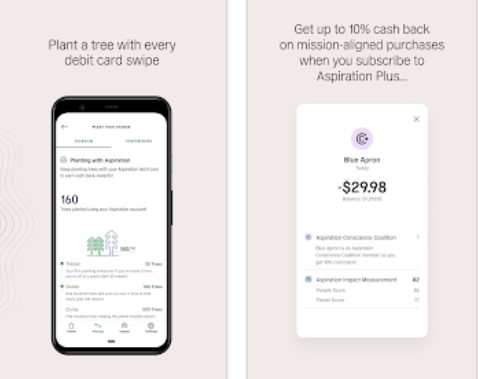

10. Aspiration Spend, Save, Invest

Your budget can be environmentally sustainable. This app can prove it. It invites you to gradually reach your goals by taking care of the environment. The developers claim that they do not cooperate with organizations that pollute our planet. So while your savings increase, a mini tree grows.

In addition, there is a definite summary that will familiarize you with environmental trends and your investment in nature. Also, you can save more easily by saving a little from each purchase you make. This way you can accumulate small amounts from everywhere and do it all the time.

The result is a nice amount of savings that will eventually be enough for your goals. In addition, the app has a whole system of ATMs from which you can easily withdraw cash. Also, the service offers a real plastic bank card with three different plans.

You may also like: 11 Best Small Investment Apps

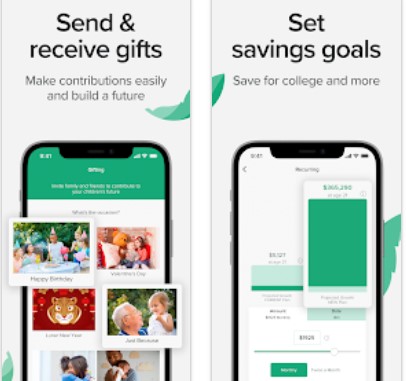

11. UNest: Investing for your Kids

This app is a project that is available to people with different economic backgrounds. The whole point of the app is to save investments for the children’s future. So, it offers a reference link for parents all over the country, attached to the child’s account.

Through it, not only relatives, but everyone, in general, can transfer a certain amount of money to the account. As time goes by, the rate of investments of the kid increases, and by his or her 18th birthday, he or she receives the entire amount collected for the entire time from the creation of the account.

Moreover, the service cooperates with large companies that you as a user can interact with. In addition, it takes no more than five minutes to create your account. After downloading the application, detailed instruction with sequential actions appears on the screen.

In case of any doubt, you can always turn to an investment advisor. He will help to set up a deposit, choose or change an investment plan and solve all the users’ questions. Besides, every user gets some knowledge about investments and finances generally while using the app.

Also, there are materials for learning new material. You can memorize it with the help of special tests and quizzes. Additionally, the program has a special section with blogs containing financial information about credit and debit cards, stocks, and all sorts of other things.