In this article, we will be exploring the top apps, which can help you calculate the inflation-adjusted value of the United States Dollar. In a similar vein, if you’re looking to track your expenses efficiently, you might want to refer to the article on the Best My Track Cost Calculator Apps.

These apps not only help you manage your budget but also provide insights into your spending habits, enabling you to make informed financial decisions. Stay tuned as we delve deeper! Whether you’re a professional or someone interested in finance, this list is sure to provide you with options that cater to your needs.

1. Inflation Calculator & Data

The main objective of the app is to compute the inflation-adjusted worth of the US Dollar. It accomplishes this with remarkable precision, utilizing information obtained from reputable financial establishments.

This guarantees that the outcomes are dependable and can be utilized for professional examination or personal comprehension.

The app is user-friendly, making it simple for users to input their data and receive precise inflation estimations. Furthermore, the app provides in-depth breakdowns of the inflation rates for various products across different periods, providing a comprehensive view of how prices have altered over the years.

Another captivating feature is the app’s data visualization capabilities. Instead of presenting raw figures, the app offers informative charts and graphs that make it easier to comprehend the data. This visual approach not only simplifies complex financial information but also enhances the app’s engagement.

In terms of pros, the capability to swiftly calculate and exhibit inflation rates is a significant advantage. With just a few taps, users can gain insight into how the value of the dollar has evolved.

However, there are a few potential drawbacks to consider. The app’s emphasis on inflation estimations might limit its appeal to a broader audience. Users seeking a comprehensive financial management tool might find the app lacking in additional features like budget tracking or investment analysis.

You may also like: 15 Best Paper Trading Apps

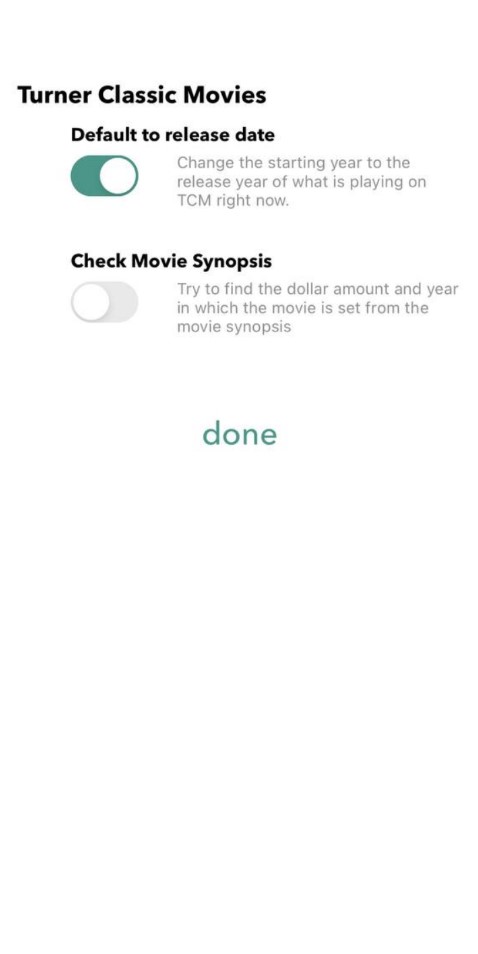

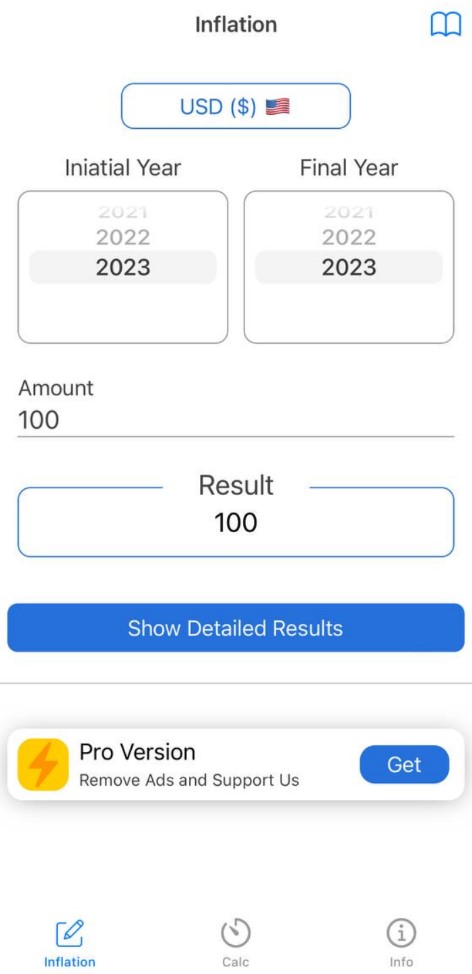

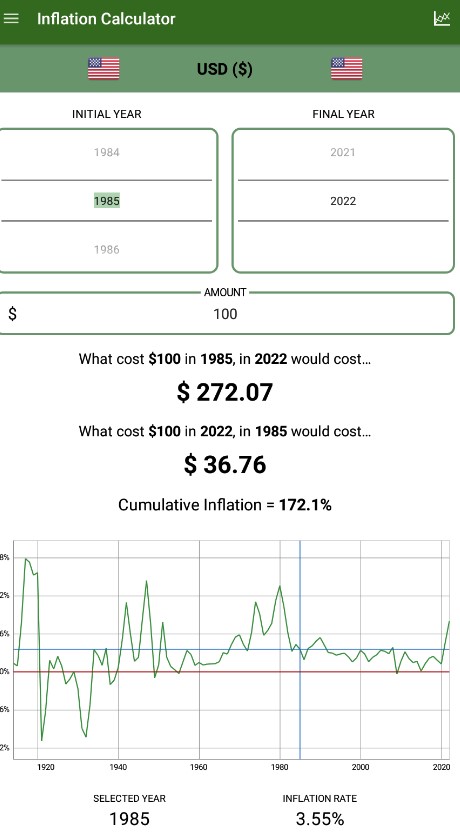

2. Inflation Calculator — TCM

The TCM application is a robust tool that computes inflation rates across different periods. It utilizes official data sources to offer precise and current information.

What distinguishes this application is its capability to break down intricate financial concepts into understandable numbers, rendering it accessible to users with various levels of financial knowledge.

Navigating through the application is relatively simple. Users just need to input the preferred year and the amount, and the application takes care of the rest, presenting the inflation-adjusted value alongside an in-depth analysis of the inflation rate during that specific period.

The application also provides supplementary features like historical inflation rates and projections, which provide users with a more comprehensive outlook on inflation trends. The visual charts and graphs are especially helpful in comprehending these patterns, thus making the application not only informative but also engaging.

Nevertheless, despite its numerous strengths, the Inflation Calculator — TCM application does have some limitations. One potential drawback is its performance. The application can occasionally be sluggish when loading data or generating results, which may potentially frustrate users who desire swift information.

Furthermore, while the application offers accurate calculations, it might not cater to the more advanced financial requirements, such as detailed investment analysis or budget tracking.

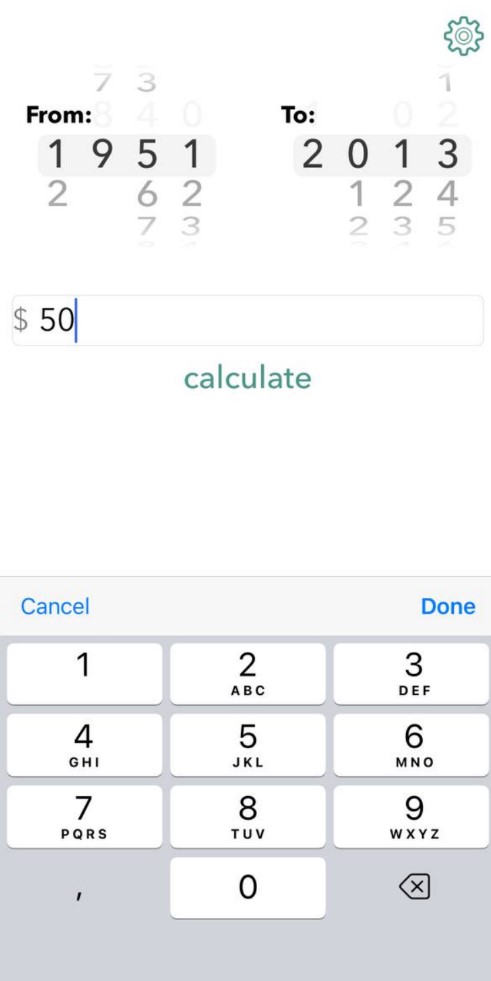

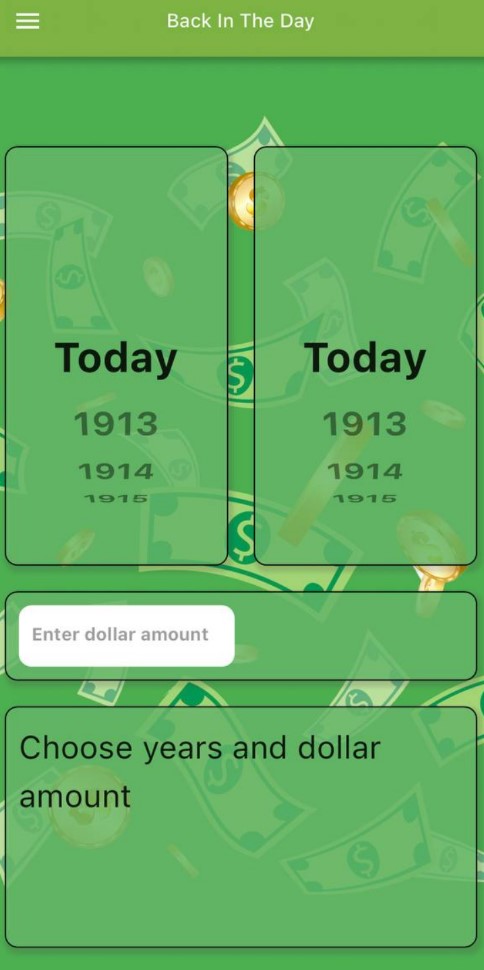

3. In The Day: US Inflation Calc

The In The Day: US Inflation Calculator app is designed to bring this abstract notion to life, providing users with a user-friendly tool for computing inflation rates across various periods.

The app’s interface is sleek and user-friendly, making it effortless for users to navigate through its functionalities. Users simply need to input the year and the amount, and the app provides the inflation-adjusted value. This simplicity makes it accessible to users with different levels of financial knowledge.

One of the distinctive features of the In The Day: US Inflation Calculator app is its precision. The app utilizes data from dependable sources to deliver accurate calculations. This ensures that whether you’re a finance professional or someone just interested in the value of money over time, you can rely on the results provided by the app.

Nevertheless, the app does have its drawbacks. While it does an exceptional job at computing inflation rates, it lacks some advanced features present in other financial apps, such as comprehensive investment analysis or budget tracking. Additionally, some users might find the absence of customization options limiting.

4. Inflation Calculator – Calc

Inflation Calculator – Calc is an application designed to simplify the intricate concept of inflation, offering users a swift and effortless method to compute inflation rates over time. The primary objective of this app is to deliver precise and dependable inflation calculations based on the input year and amount.

Navigating through the application is a breeze thanks to its neat and user-friendly interface. Users can effortlessly input their data, and the app promptly presents the inflation-adjusted value.

The application’s most notable characteristic is its precision. It utilizes data from reputable sources to provide accurate inflation calculations, eliminating the guesswork commonly associated with such computations. This precision serves as a testament to the app’s reliability, making it a valuable tool for anyone wishing to comprehend the dynamics of inflation.

However, despite its strengths, Inflation Calculator – Calc does have a few limitations. One possible drawback is the absence of customization options. Users are unable to modify the appearance and feel of the app to match their preferences, which might be off-putting for some.

Moreover, the app does not offer visual aids such as graphs and charts, making it less captivating compared to other financial applications that provide these features.

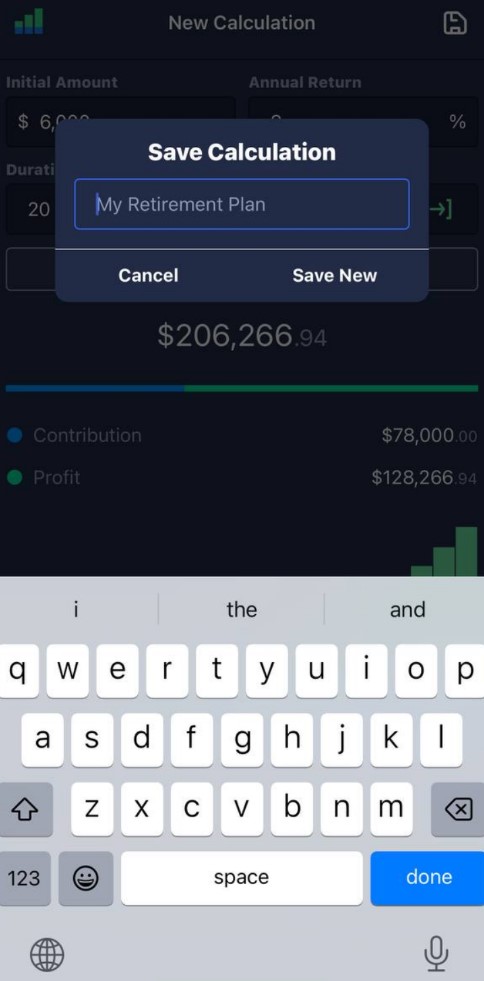

5. Compound Interest Calculator F

This is an application designed to streamline the intricate computations often associated with compound interest. It aims to offer users a speedy and effortless approach to compute compound interest on investments, taking into consideration factors like the principal amount, interest rate, compounding interval, and duration.

One of the main advantages is its user-friendly design. The interface is neat, intuitive, and easy to navigate, even for novice users. This simplicity makes the application accessible to a wide array of users. It caters to both finance experts and individuals just initiating their investment journey.

In addition to its core functionality, the application also provides a visual representation of investment growth. This graphical aid assists users in comprehending the impact of compound interest on their investments, making the application not just informative but also captivating.

However, despite its numerous strengths, the application does have limitations. One potential drawback is the absence of customization options. Users cannot modify the appearance and ambiance of the application to align with their preferences, which might deter some individuals.

Moreover, while the application delivers precise calculations, it may not cater to more advanced financial necessities, such as detailed investment analysis or budget tracking.

You may also like: 15 Best Apps For US Freelancers

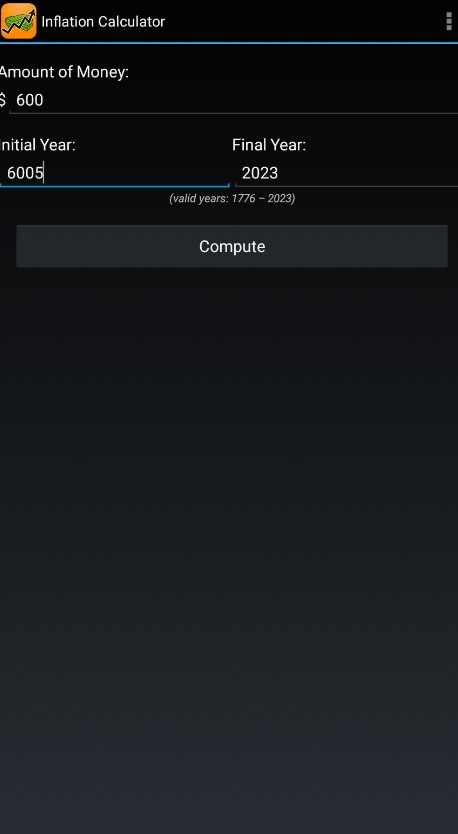

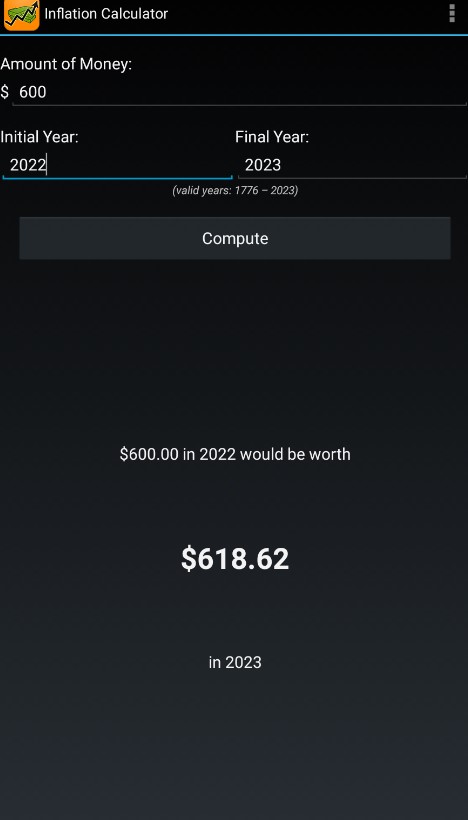

6. Inflation Calculator 1776-now

The Inflation Calculator 1776-now application is a straightforward yet potent tool that computes the inflation rate from 1776 to the present time in the United States. It offers a user-friendly overview of how the purchasing power of money has altered over time due to inflation.

Navigating through the application is a breeze. You simply input the sum of money, select the initial year, and pick the final year. The application then presents the inflation-adjusted value, displaying how much that amount of money would be worth in today’s currency.

Unlike numerous other inflation calculators, the Inflation Calculator 1776-now app provides data going back to 1776, thereby serving as a valuable tool for those intrigued by long-term economic patterns.

Nevertheless, the application does have its limitations. Firstly, it solely offers data for the United States, rendering it less valuable for individuals interested in global inflation trends. Additionally, the data only encompasses the time frame from 1776, omitting earlier historical periods.

Despite these drawbacks, the Inflation Calculator 1776-now app can be a formidable tool within your financial arsenal. By comprehending past inflation patterns, you can make more informed choices about your personal finance planning and investment strategies.

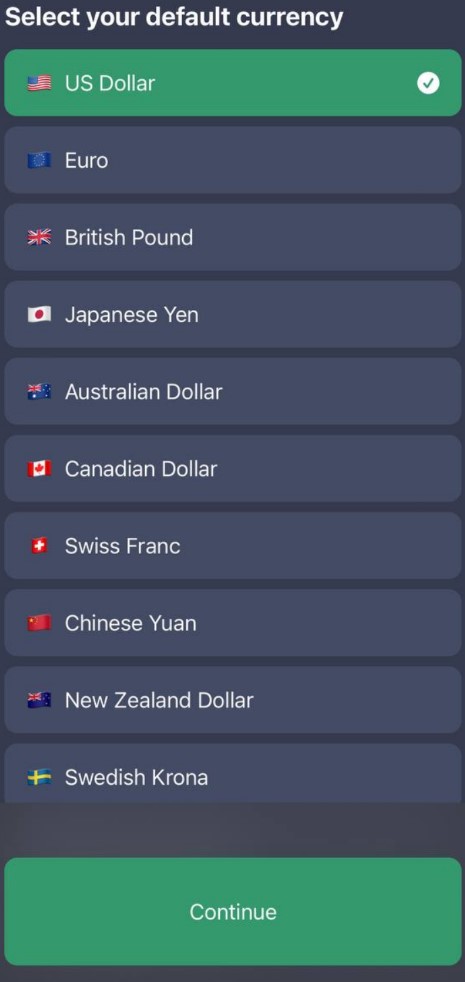

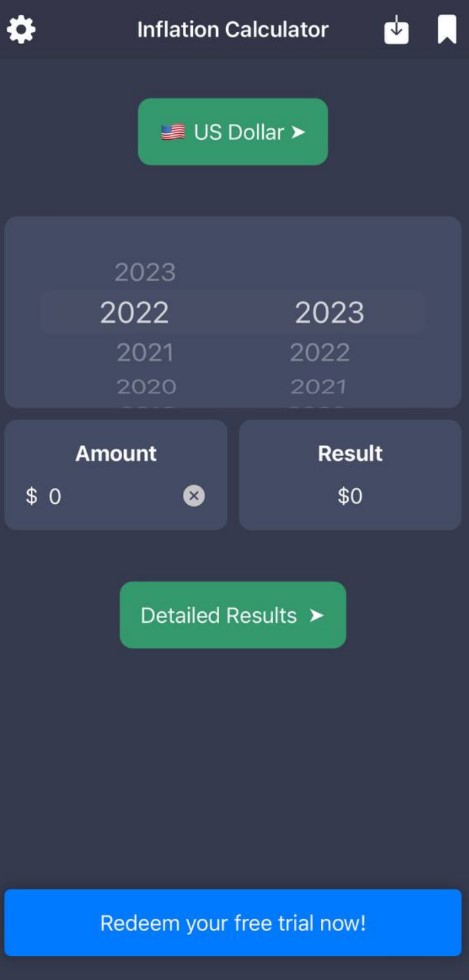

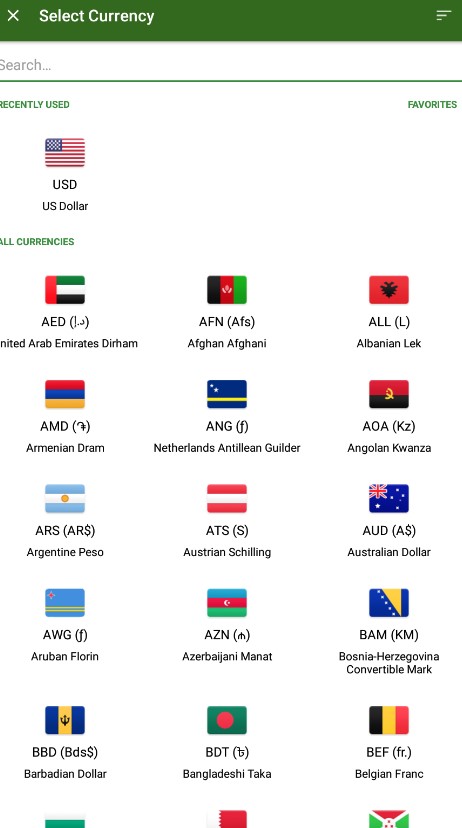

7. 150+ Currency Inflation Calc

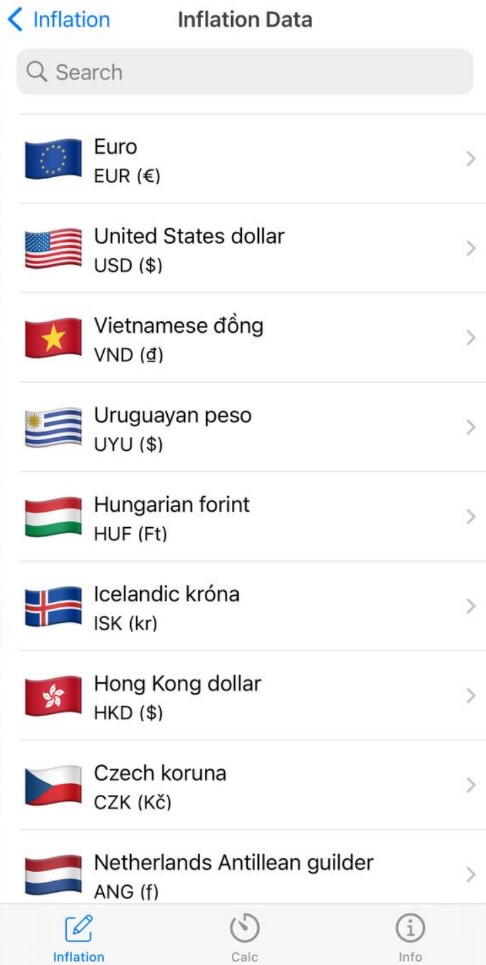

The Currency Price Calculator is a tool created to offer users real-time inflation rates and currency exchange projections. It utilizes historical information to compute these figures, assisting businesses and investors in making well-informed monetary decisions.

At its core, the app serves as a utility for calculating inflation rates across various currencies. Users input their base currency and the currency they want to contrast it with, and the app generates a comprehensive analysis based on past data.

The user interface of the Currency Inflation Calculator is neat and user-friendly. Navigation is simple, with clear labels and prompts making it effortless for first-time users to begin. The app also provides a useful tutorial that guides users through the process of inputting data and interpreting the outcomes.

One of the key strengths of the Currency Inflation Calculator is its user-friendliness. The app’s design makes intricate monetary calculations accessible to a wide audience. Its precise real-time forecasts of inflation rates and currency exchange rates can be invaluable for businesses and investors strategizing financial approaches.

However, the app is not devoid of weaknesses. While it generally provides precise projections, there can occasionally be inconsistencies in the inflation and exchange rate forecasts. This may be attributed to the inherent unpredictability of economic factors or limitations in the data sources employed by the app.

Some users have also reported performance problems, such as occasional delays or freezing. These problems appear to be sporadic and may rely on the device or operating system being utilized.

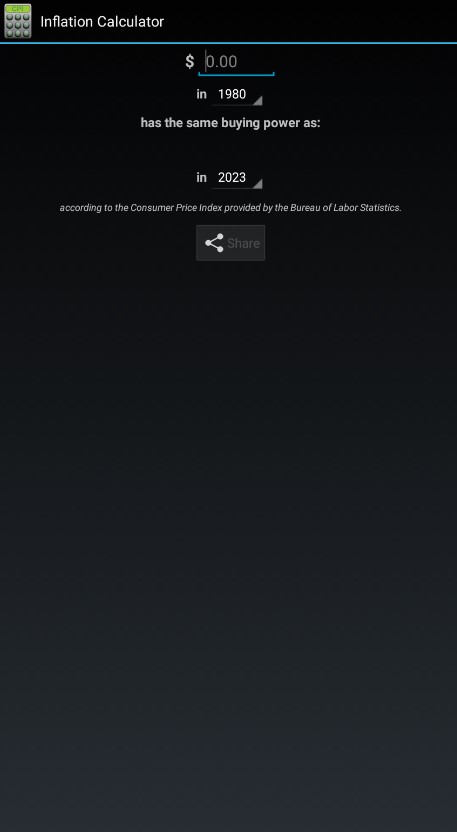

8. CPI Inflation Calculator

The CPI Inflation Calculator is an application built to provide users with a clear understanding of how inflation impacts their purchasing ability. By leveraging the Consumer Price Index (CPI) data, this app offers a user-friendly interface to calculate the inflation rate and changes in money value over time.

One of the main benefits of the CPI Inflation Calculator is its capacity to determine the inflation rate based on the CPI. Users can simply input the starting and ending year, along with the desired amount of money for inflation adjustment.

The user experience of the CPI Inflation Calculator is commendable. The design is clean and straightforward, enabling users to navigate the app effortlessly. The process of entering data and generating results is intuitive, making it accessible even to individuals who may not have financial expertise.

Regarding accuracy, the CPI Inflation Calculator relies on dependable data sources for its calculations. The app regularly updates its database with the most up-to-date CPI data, ensuring the accuracy and currency of the generated inflation rates.

However, the app does have a few drawbacks. One potential limitation is its provision of only national average inflation rates. Consequently, it may not fully represent the inflation experienced in specific regions or cities, which can differ from the national average.

Another downside is the absence of predictive capabilities. While it offers historical data, the app does not forecast future inflation rates. This could be a notable drawback for individuals looking to plan.

Despite these limitations, the CPI Inflation Calculator sets itself apart with its simplicity and accuracy. It serves a particular market niche by providing an accessible tool for understanding the impact of inflation on purchasing power.

9. Inflation Calculator CPI RPG

In a world where economics and finance can often appear dull and inaccessible, the Inflation Evaluator CPI RPG application aims to revolutionize the game. Its goal is to make these subjects more engaging and accessible to all.

The main function of the app is to compute the inflation rate based on the Consumer Price Index (CPI). Users can input their initial amount of money, the starting year, and the ending year. By doing so, they can witness how inflation has affected their purchasing power over time.

But what distinguishes the Inflation Evaluator CPI RPG is its innovative role-playing game format. As users progress through the game, they encounter various economic scenarios. These scenarios demand them to calculate inflation rates and make financial choices.

The user experience of the Inflation Evaluator CPI RPG app is highly captivating. Navigating through the app is akin to embarking on an economic quest, complete with characters, missions, and rewards. The design is visually attractive, with vibrant graphics and user-friendly controls.

However, the combination of inflation computation and RPG might be puzzling for some users. Particularly for those who prefer direct financial applications.

Another potential drawback is the app’s strong dependence on the CPI for its calculations. This implies that it may not wholly reflect the inflation experienced in specific regions or cities.

You may also like: 11 Best Apps That Round-Up Purchases To Save Money

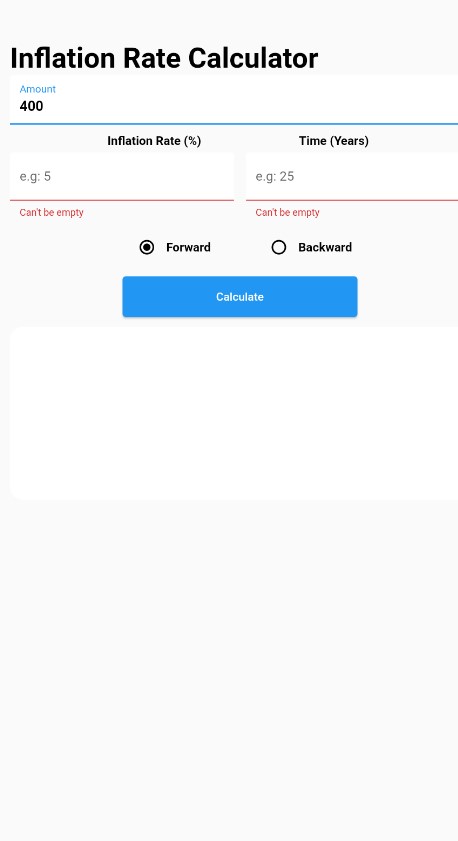

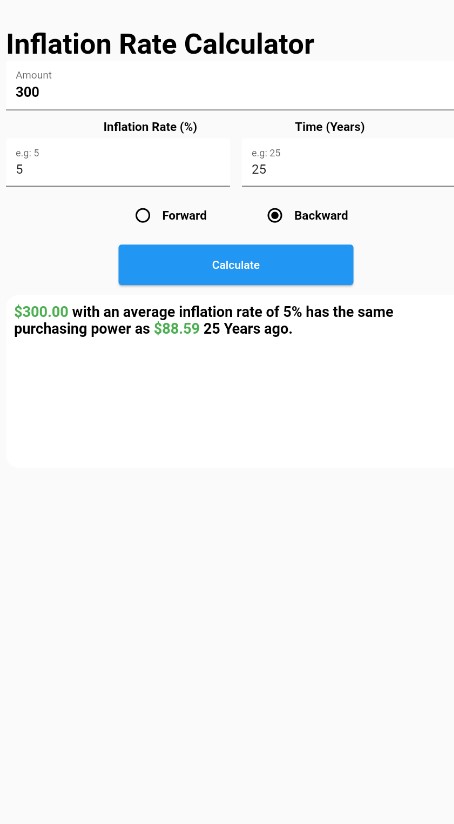

10. Inflation Rate Calculator

Theflation Rate Calculator app also provides real-time updates on current inflation rates. This feature can be extremely beneficial for financial planning. It utilizes reliable data sources to offer precise and up-to-the-minute information. This ensures that users have the most relevant data at their fingertips.

However, like any application, the Inflation Rate Calculator has a few potential limitations. One of the primary constraints is that it solely presents general inflation rates. It does not offer sector-specific or region-specific inflation data.

Another limitation is that the app heavily relies on the accuracy of user input. If a user inputs incorrect data, the calculated inflation rate will also be inaccurate. Therefore, users must ensure they are entering precise and up-to-date information into the app.

Moreover, while the app is generally user-friendly, some users might find the interface slightly intricate. Especially if they are unfamiliar with economic concepts. A more detailed tutorial or guide could enhance the app’s accessibility for these users.